Computershare General Transfer Package 2022-2026 free printable template

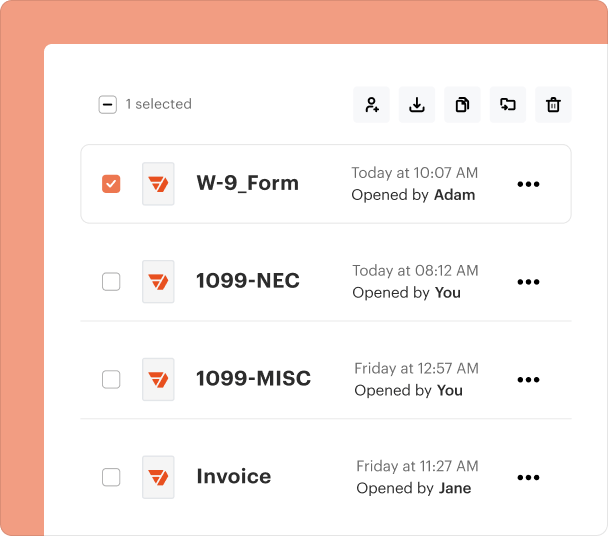

Fill out, sign, and share forms from a single PDF platform

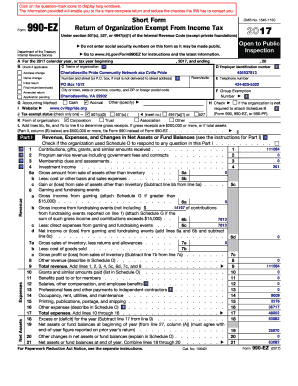

Edit and sign in one place

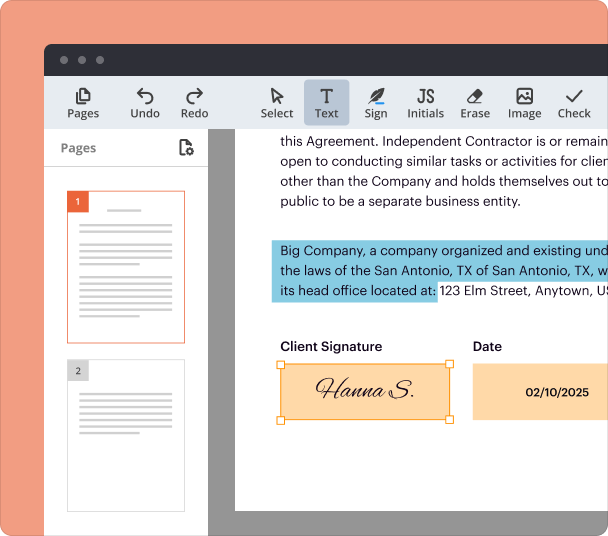

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

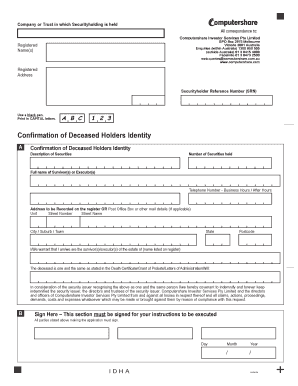

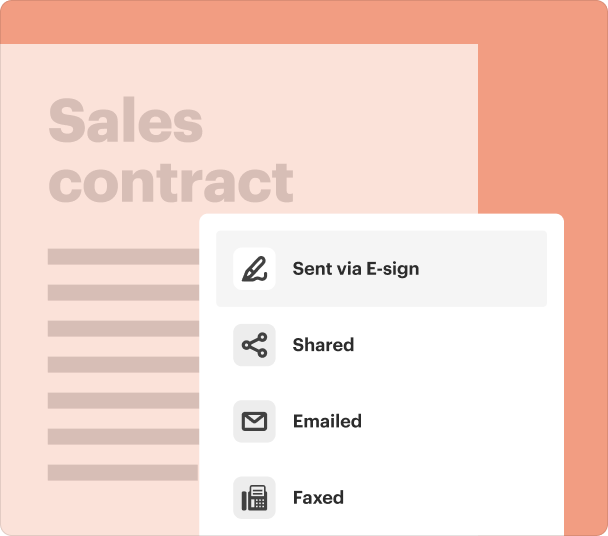

How to fill out a Computershare general transfer package form

What is the Computershare general transfer package form?

The Computershare general transfer package form is essential for transferring stock ownership. This document ensures that all required information is accurately conveyed to facilitate a smooth transfer process. Understanding this form's purpose and significance lays the groundwork for efficient stock transfer.

-

The form facilitates the transfer of stock ownership from one party to another.

-

It serves as a formal record that can be used to prevent disputes regarding ownership.

Proper completion of this form is vital to ensure compliance with regulatory requirements and to avoid additional processing delays.

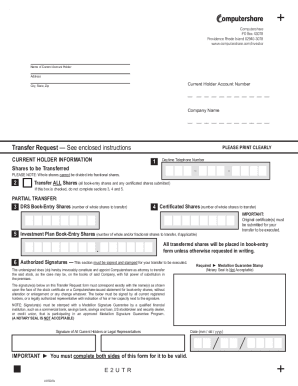

How to complete the Computershare transfer form?

Completing the Computershare transfer form involves several critical steps that must be followed meticulously to ensure successful processing. Each step has its specific requirements that must be adhered to.

-

Provide all required information including your account details and the recipient's information.

-

Ensure you sign in the designated section to validate the transfer request.

-

This is typically required for securities transactions and verifies that the signatures provided are genuine.

-

Include all necessary documentation and fees when submitting your transfer request.

Following these steps carefully will help streamline the transfer and reduce the chances of errors that may arise during the submission.

What signatures and notary information are required?

Signatures play a crucial role in verifying the legitimacy of the transfer request. Knowing who is required to sign can prevent unnecessary delays.

-

Both parties involved in the transfer generally need to provide their signatures.

-

This guarantee provides added security and may be required to process certain transfers.

-

In specific circumstances, eligible residents may not need this guarantee, making the process easier.

It's vital to ensure all signatures are collected to prevent any delays in processing the transfer.

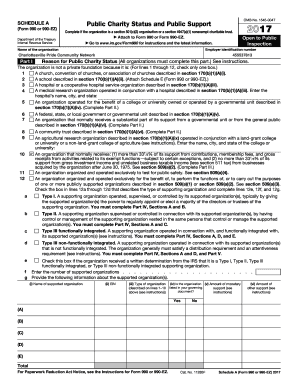

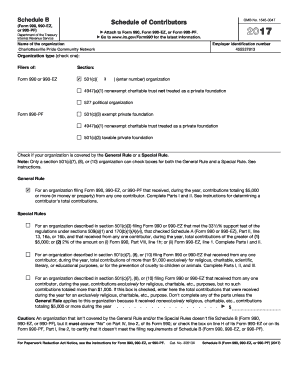

How to navigate cost basis reporting requirements?

When transferring shares, understanding cost basis reporting is crucial for tax purposes. The IRS mandates that certain information regarding gains or losses must be reported.

-

Methods like FIFO (First In, First Out) are common, but you have the option to choose other methods as permissible.

-

Seeking advice from a tax professional can clarify which calculation method is best suited for your situation.

-

Ensure compliance with all regulatory obligations when reporting your cost basis.

Correct reporting protects you from potential audits and ensures you meet all obligations associated with the transfer.

What are the special considerations for non-US residents?

Non-US residents have specific requirements when it comes to completing the Computershare transfer form. Understanding these differences is essential to avoid processing issues.

-

Certain adjustments may need to be made in the type of forms used.

-

Different regulations may apply based on the resident's country, affecting the documentation needed.

-

The transfer process may differ based on the account location and regulations in specific jurisdictions.

Being informed about these variations can aid in successfully completing the transfer process without setbacks.

How to navigate the Computershare website?

Finding the right forms or resources on the Computershare website can save time and frustration. Utilizing their online tools efficiently can help in managing your transfer needs.

-

The form can be found easily through the 'Forms' section of the Computershare website.

-

The Help section is a valuable resource that addresses common queries related to the transfer process.

-

For complex inquiries, live support options are available to provide prompt assistance.

Understanding how to navigate their website enhances your experience and can significantly expedite the transfer process.

Frequently Asked Questions about computershare stock transfer request forms

What should I do if I make a mistake on my transfer form?

If you make a mistake on your transfer form, it's crucial to correct it before submission. Generally, you can cross out the error and initial the correction or fill out a new form.

How long does the transfer process take?

The transfer process duration varies but typically takes 2 to 4 weeks. Factors such as accuracy of submitted information and volume of requests can influence this timeline.

Is there a fee for transferring stocks?

Yes, there may be fees associated with transferring stocks, depending on the transfer agent's policies. It's best to check with Computershare for specifics.

What if I need to transfer shares held in a trust?

Transferring shares held in a trust may require additional documentation to verify the trust’s legitimacy. Consult the Computershare guidelines or seek legal advice for proper procedures.

Can I track my transfer request status?

Yes, you can track the status of your transfer request through the Computershare website or by contacting their customer support.

pdfFiller scores top ratings on review platforms